what is a deferred tax provision

The right to pension is a constitutional right. Deferred tax is a topic that is consistently tested in Financial Reporting FR and is often tested in further detail in Strategic Business Reporting SBR.

Decrease the book profit by the amount of deferred tax if at all such an amount appears on the credit side of the profit and loss account.

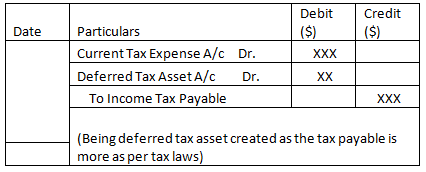

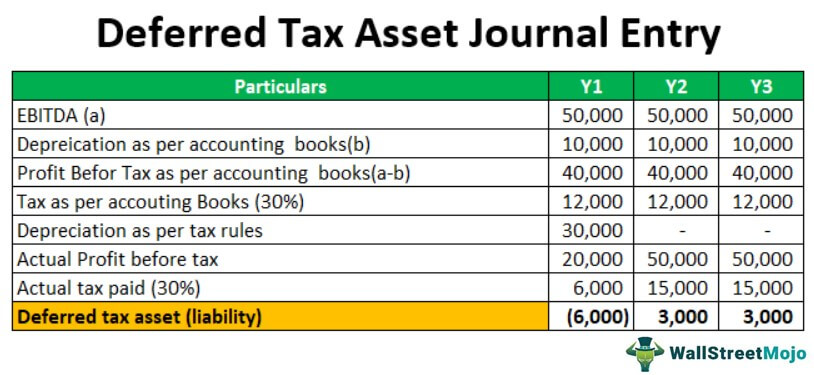

. Petitioners are retired employees of the Kerala Books and Publications Society. The deferred income tax is a liability that the company has on its balance sheet but that is not due for payment yet. If the tax rate is 30 the Company will make a deferred tax asset journal entry Deferred Tax Asset Journal Entry The excess tax paid is known as deferred tax asset and its journal entry is created when there is a difference between taxable income and accounting income.

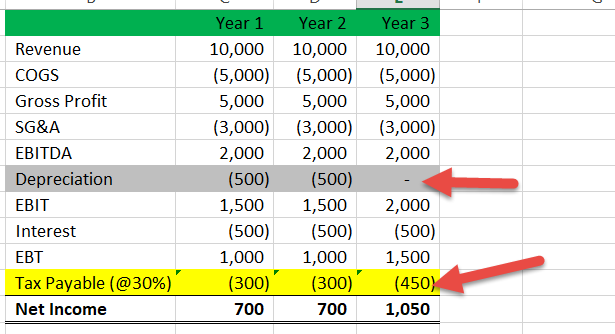

Deferred tax charge is not a provision for tax but is a provision for tax effect for difference between taxable income and accounting income and further that deferred tax charge cannot be termed as income-tax paid or payable which has to be paid out of the profit earned. Underover provision of tax in a prior year Arising on temporary differences. A companys current tax expense is based upon current earnings and the current years permanent and.

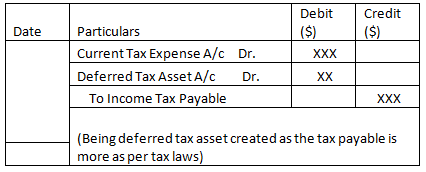

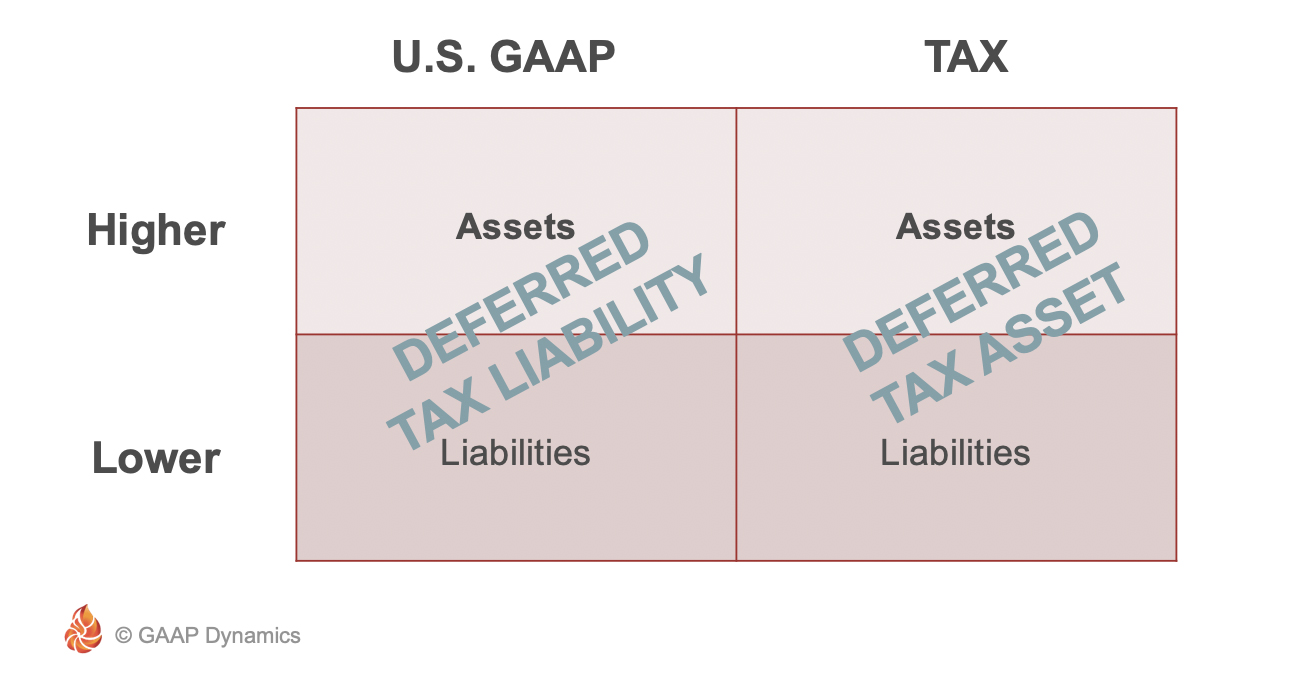

A temporary difference is the difference between the asset or liability provided on the tax return tax basis and its carrying book amount in. The journal entry for deferred tax asset is. A provision is recognised under IAS 37 which will be deducted from taxable income in the future on a cash basis.

Employees Pension Scheme was made applicable. In practice it does not appear to be common to adapt the format of the balance sheet. Current Tax Expense Dr.

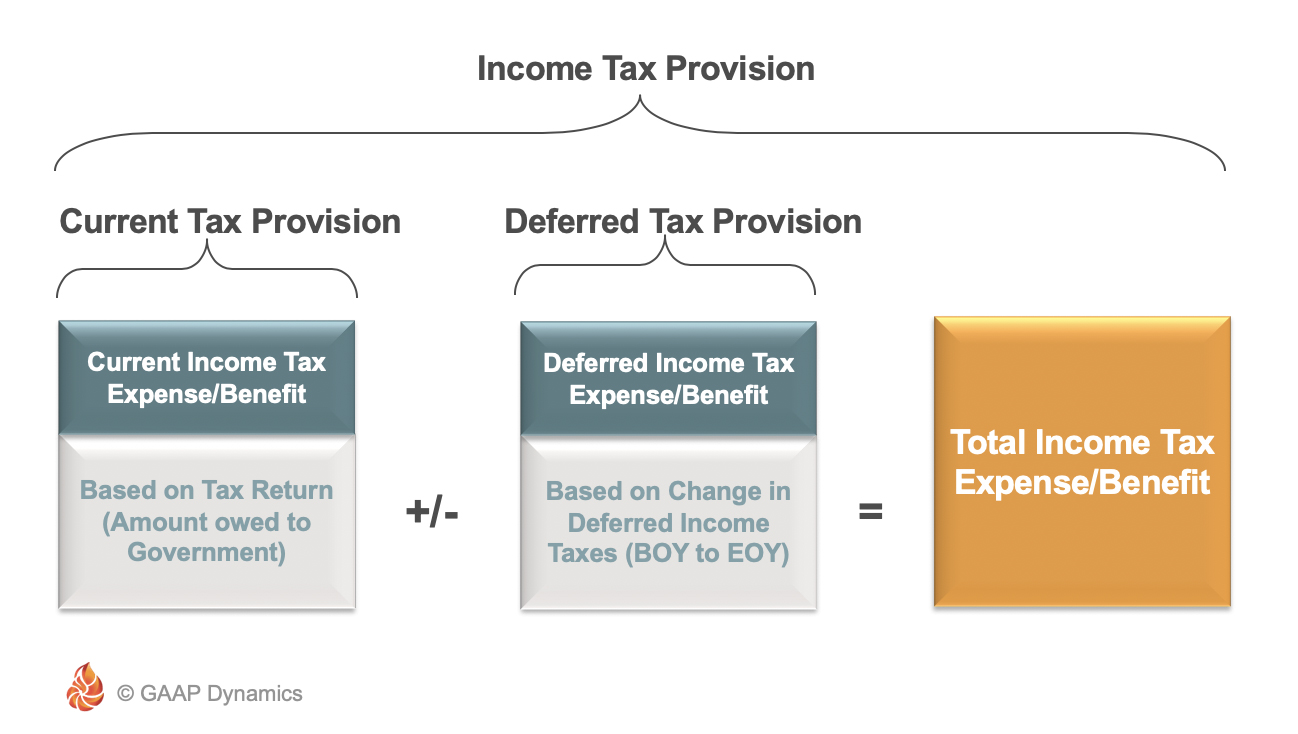

Depreciation on fixed assets. Non-governmental tax-exempt entities can establish 457f ineligible plans that are tax deferred and that allow contributions exceeding the annual deferral limit. A tax provision is comprised of two parts.

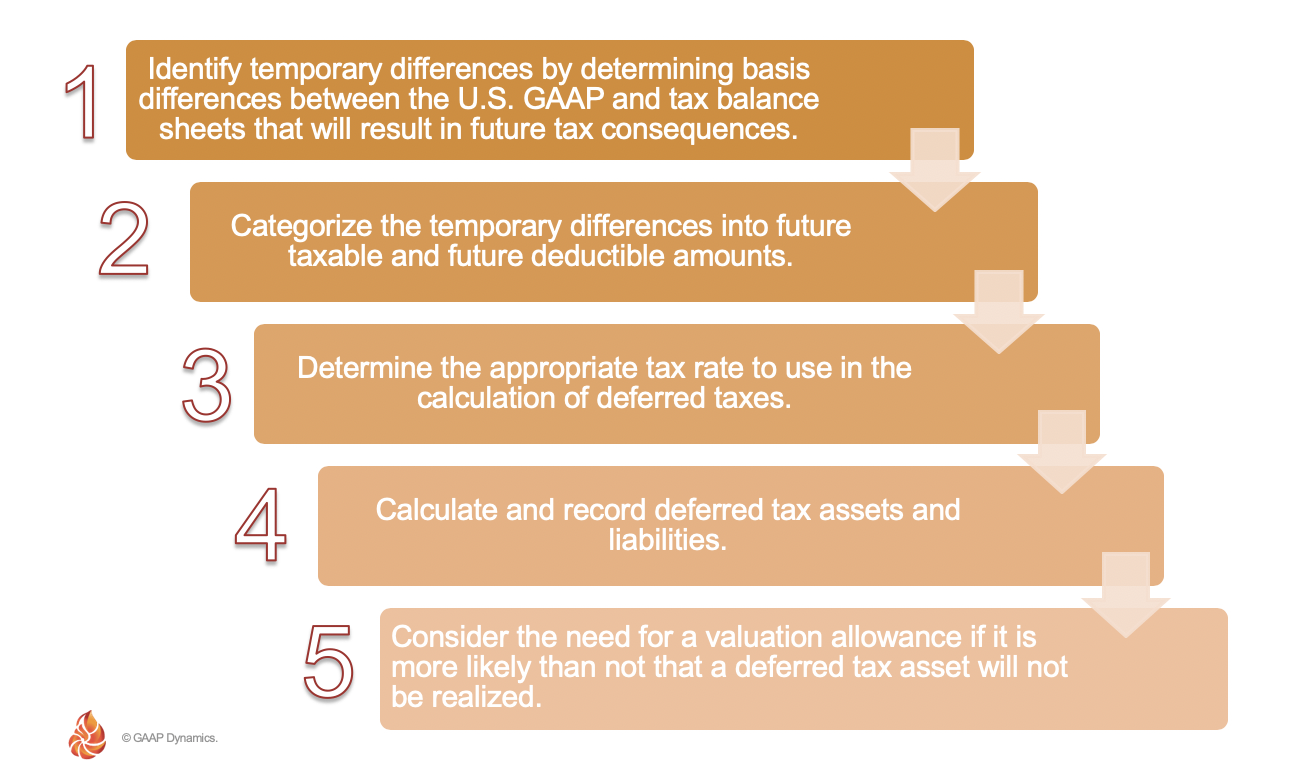

Reserves mentioned in Section 115JB are different it can be. Deferred tax assets and liabilities are normally recorded with the offsetting entry to the PL deferred tax expense. This article will start by considering aspects of deferred tax that are relevant to FR before moving on to the more complicated situations that may be tested in SBR.

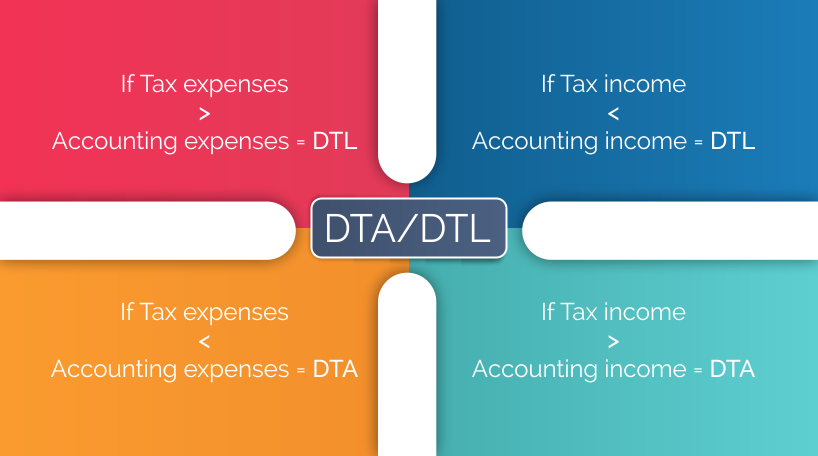

Current income tax expense and deferred income tax expense. Provision on doubtful accounts or debt or warranty. The Wisconsin Deferred Compensation Program WDC 457 Program is a supplemental retirement savings plan regulated by Section 457 of the Internal Revenue CodeThrough the WDC program employees can invest a portion of their income for retirement either on a pre-tax or post-tax Roth basis or a combination of both.

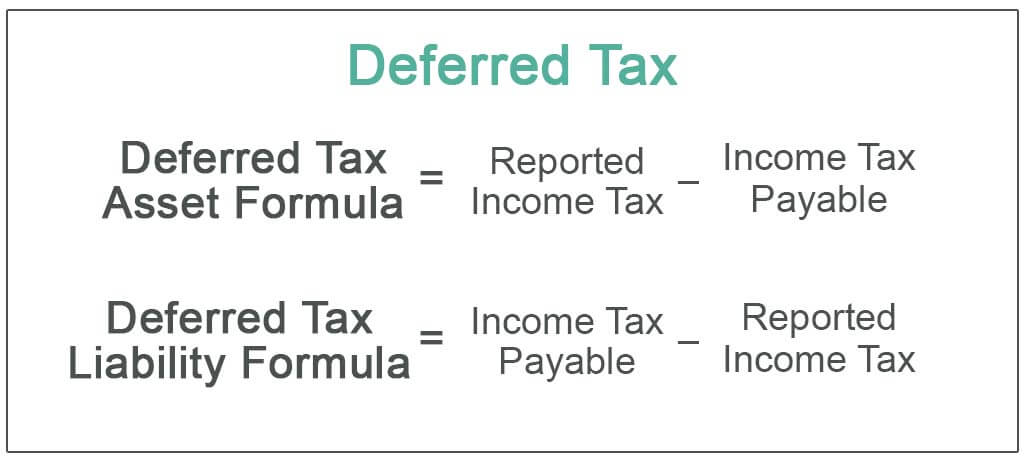

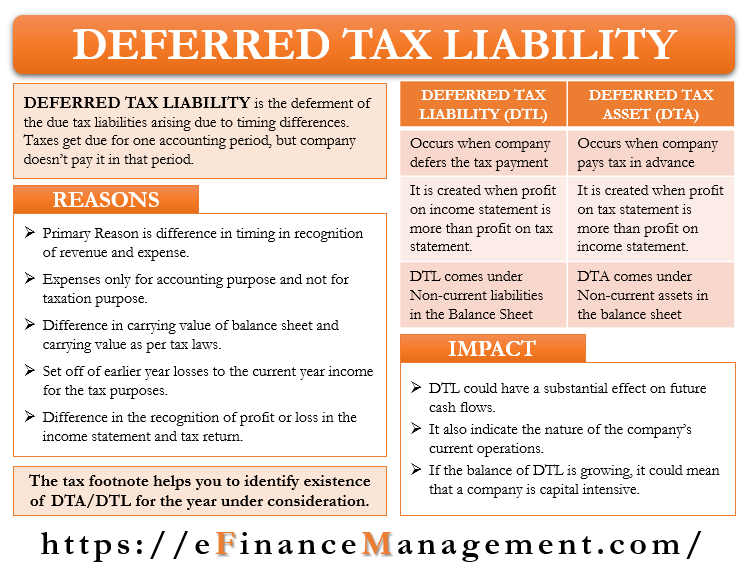

The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions Accounting Provisions The provision in accounting refers to an amount or obligation set aside by the business for present and future commitments. Deferred income tax expense. Deferred tax is a notional asset or liability to reflect corporate income taxation on a basis that is the same or more similar to recognition of profits than the taxation treatment.

Interest expense is an allowable cost for corporation tax in line with the provision of the ITA. However in its tax statements it has not mentioned that provision due to which their gross profit is Rs. They gave me RSU and ESPP as Perq and deducted TDS for A.

FRS 102 also prohibits an entity from offsetting deferred tax assets and deferred tax liabilities. Therefore it is creating a deferred tax asset of Rs. Deferred tax income for current year 5000 5000-0 The company profit before tax is 80000.

However it is the profit in accounting base so we have to make adjustment to determine taxable income by adding 20000 as revenues in 2017. Students must also evaluate and record a valuation allowance and perform and properly report an intraperiod. Users must identify multiple temporary and permanent differences prepare a book-tax reconciliation calculate deferred tax assetsliabilities enter the tax provision journal entries and produce the effective tax rate reconciliation.

C Deferred tax arises if at the end of the year the carrying amount it different from the tax base. So have to return deferred tax amount to IT dept. Interim reporting effective tax rate IAS 3430a requires the use of the so called effective tax rate ETR method as the most appropriate depiction of a reporting issuers tax provision on a quarterly basis.

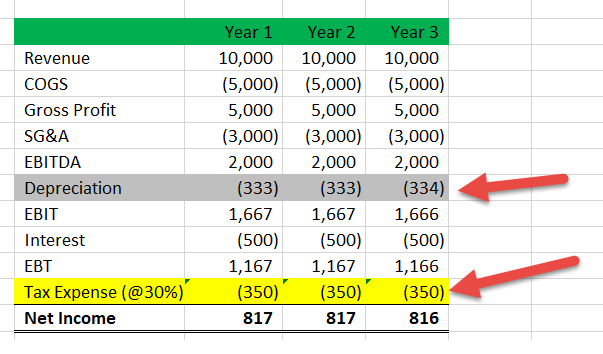

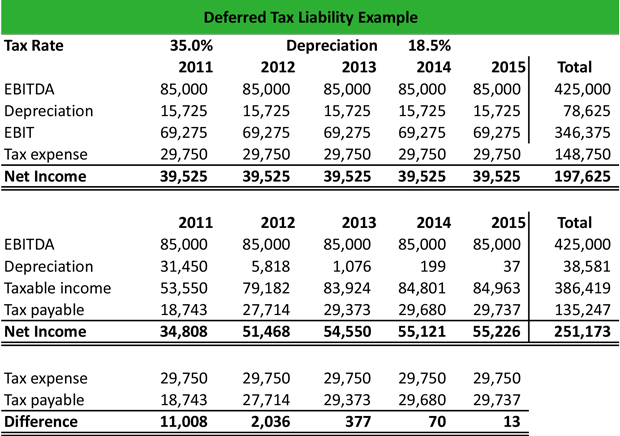

Deferred tax liabilities can arise as a result of corporate taxation treatment of capital expenditure being more rapid than the accounting depreciation treatment. Deferred tax assets where these meet the strict recognition criteria are presented within debtors unless the entity has chosen to adapt its balance sheet. 21-22While filing ITR the SYSTEM auto considered provision of deferred tax for employee of startup and refunded the amount of deferred.

Deferred tax is not recognised if it arises on initial recognition of assetsliabilities in a transaction which is not a business combination and at the time of the transaction affects neither accounting profit nor taxable. This could result in a change in the appropriate tax rate used to measure certain components of deferred tax. The payroll tax deferral period begins on March 27 2020 and ends December 31 2020.

Increase the book profit by the amount of deferred tax and its provision or. The result is your companys current year tax expense for the income tax provision. Based on the provisions of Section 161 b of the Income Tax Act which prohibits a deduction in respect of capital expenditure or any loss diminution or exhaustion of capital.

Deferred tax liability is created when the Company underpays the tax which it will have to pay shortly. Kerala High Court Held that pension is deferred salary akin to property under Article 300A of the Constitution of India. Tax expense per SOCI 28 of profit before tax but it is not due to.

This more complicated part of the income tax provision calculates a cumulative total of the temporary differences. Section 2302a2 of the CARES Act provides that deposits of the employers share of Social Security tax that would otherwise be required to be made during the payroll deferral period may be deferred until the applicable date For more information see What. Deferred tax is the tax effect of timing differences.

Deferred tax is the tax that is levied on a company that has either been deducted in advance or is eligible to be carried over to the succeeding financial years. Income Tax Slab Tax Rates for FY 2021-22 AY 2022-23. This article will highlight some of the important aspects of an income tax provision and how it clarifies GAAP financial statements.

These plans and the associated deferrals are possible only if there is a substantial risk of forfeiture when the risk has been removed the participants deferral amounts.

Net Operating Losses Deferred Tax Assets Tutorial

Deferred Tax Liabilities Meaning Example Causes And More

Ias 12 Example Incl Deferred Tax Acca Financial Reporting Fr Youtube

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Deferred Tax Asset Deferred Tax Assets Vs Deferred Tax Liability

What Is Deferred Tax Asset And Deferred Tax Liability Dta Dtl Taxadda

Deferred Tax Liabilities Meaning Example How To Calculate

Deferred Tax Asset Journal Entry How To Recognize

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Tax Double Entry Bookkeeping

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Define Deferred Tax Liability Or Asset Accounting Clarified

Define Deferred Tax Liability Or Asset Accounting Clarified

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)